Happy Sunday Red Staters 🇺🇸,

Good morning and congratulations—you survived another week of media meltdowns, and whatever fresh nonsense Congress is cooking up. As always, we’re here to break it all down with the sarcasm you deserve.

America has spoken! Last week’s poll winner was YES, scrap daylight savings, with a whopping 83% of you voting to stop playing musical chairs with the clocks. Now if only Congress could move that fast on things that actually matter. Meanwhile, Trump’s team went full Scooby-Doo and exposed Biden’s fake Zoom office in the White House. That’s right—Sleepy Joe was holding meetings from a staged set, because apparently, he needed Hollywood magic to convince people he was actually running things.

On the financial front, DOGE (not the meme, but Musk’s gov-waste watchdogs) claims they’ve saved $115,000,000,000 in taxpayer money. That’s billion with a B. If you’re wondering where that money was going before… so are we. And speaking of bad spending, Democrats, still leading in poor life choices, have now resorted to vandalizing Teslas to protest… something? At this point, they just seem mad at electricity itself.

But hey, not all news is terrible—several states are actively working to END property taxes, which is shockingly a popular idea. Meanwhile, mortgage rates are hanging near three-month lows, so if you’ve got a spare down payment lying around (unlikely, thanks to inflation), now might be the time to pounce.

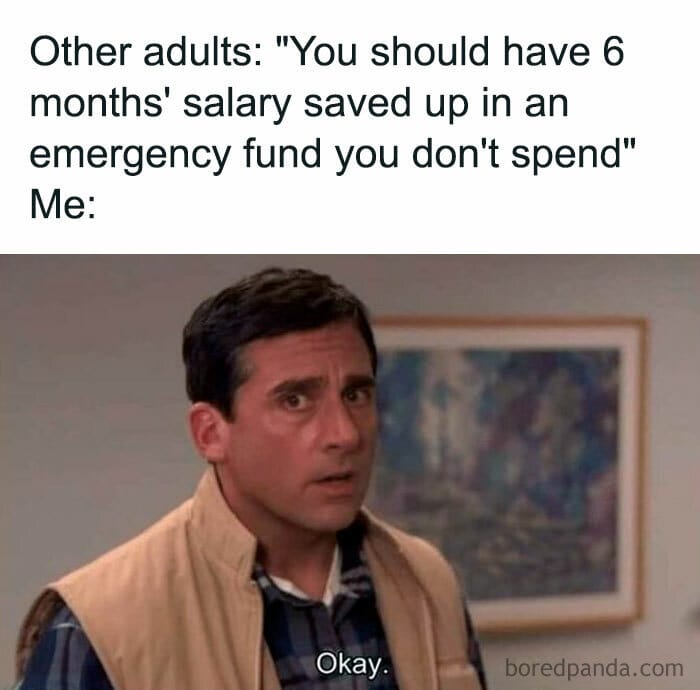

Remember when a gallon of milk didn’t require a credit check?

Yeah, good times. Between grocery prices that make you do a double take, rent that’s basically a second mortgage, and gas prices playing a game of "How high can we go?"—America is feeling less like the land of opportunity and more like the land of please let my paycheck last until Friday.

So, we gotta ask—have you had to make any “fun” lifestyle changes just to keep up with the cost of, well, existing? Vote below and let us know how creative your budgeting skills have become.

Have you had to make any “fun” lifestyle changes to keep up with the ever-rising cost of living in the U.S.?

Todays Mood:

The Rundown This Week:

Another One Bites the Dust: TD Bank Shutters 38 Branches Amid Scandal

Nothing says “trustworthy financial institution” like shutting down 38 branches after getting slapped with massive penalties for anti-money laundering failures. TD Bank, America’s seventh-largest bank, just told customers across 10 states to find a new ATM by June 5. But don’t worry, folks—this has nothing to do with reckless banking practices or government overreach (wink, wink).

With closures hitting states like New York, New Jersey, and Florida, customers are left wondering: What’s next? Another “too big to fail” bailout? Meanwhile, Washington regulators seem more interested in targeting small businesses and conservative donors than, you know, actual banking failures.

The “Trump Slump” Myth: Economists Who Couldn’t Predict a Sunrise Blame 45 for Everything

Brace yourselves, folks—the same “expert” economists who failed to see inflation coming are now warning that Trump’s economic policies are about to tank the job market. Apparently, a man who hasn’t been in office for the past four years is single-handedly responsible for a supposed $4 trillion stock market loss. Meanwhile, the dems inflation disaster, reckless spending, and crippling interest rates? Totally unrelated.

Despite steady hiring and economic growth at the actual moment, these analysts predict the job market will collapse in under six months. Sounds more like a scare tactic than real analysis. But hey, if Biden’s economy was so great, why did voters—and their wallets—beg for a return to 2017?

Elon Musk Cuts Up Bureaucracy’s Credit Cards—Swamp Creatures Hardest Hit

Looks like Uncle Sam’s spending spree just hit a speed bump. The Department of Government Efficiency (DOGE)—yes, that’s really its name—just shredded 200,000 federal government credit cards after discovering they were unused or unneeded. Translation: Bureaucrats have been hoarding taxpayer-funded expense accounts like they’re Pokémon cards.

Under Elon Musk’s leadership, DOGE is actually doing something Washington hates—saving money. With federal agencies racking up $40 billion on credit cards last year, it’s no wonder the government loves raising the debt ceiling. But don’t worry, swamp insiders—we’re sure there’s still plenty of taxpayer-funded slush floating around to cover those steak dinners.

In Partnership With:

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Seniors Now Funding Retirement with Visa and MasterCard

Bad news, folks—America’s seniors are now experiencing the joys of high-interest debt just to cover basic expenses. According to a new AARP report, nearly half of Americans over 50 with credit card debt are using plastic to pay for food, housing, and health care. Because nothing says “golden years” like racking up double-digit interest just to keep the lights on.

And it’s only getting worse—37% of seniors have seen their debt increase over the past year, with nearly half carrying balances over $5,000, and a staggering 28% drowning in $10,000+ worth of credit card debt. But don’t worry, Biden’s was totally focused… on sending billions to Ukraine, expanding IRS audits, and “forgiving” student loans for gender studies grads. Meanwhile, the people who actually built this country are left financing retirement at 24% APR.

JP Morgan CEO to Gen Z: Get Off Zoom and Get to Work

Jamie Dimon, CEO of America’s largest bank and apparent slayer of remote work dreams, just dropped a truth bomb on a room full of Stanford students: Work from home is over—deal with it.

During a Q&A at Stanford’s Graduate School of Business, Dimon made it clear he’s “had enough” of the WFH era, calling it ineffective for his business. Translation: The days of “working” in pajamas while watching Netflix are numbered. Dimon’s comments come after his leaked expletive-filled rant about ending hybrid work at JPMorgan, proving once again that in the real world, showing up actually matters. But hey, maybe the kids in that room can write a think piece about “toxic capitalism” from their local Starbucks.

What Else You Might’ve Missed:

Musk Bets Big on America—And Trump’s Policies—While the Left Melts Down

Elon Musk just dropped a major announcement: Tesla is set to double its U.S. vehicle production in the next two years. But the real kicker? He’s doing it as “an act of faith in America”—and specifically, because of Trump’s economic policies. Cue the collective meltdown from the left.

Standing alongside President Trump at the White House, Musk made it clear that strong leadership—not endless regulations and climate hysteria—creates real economic growth. Meanwhile, Trump pledged to buy a Tesla, because nothing triggers the woke mob more than a billionaire and a former president standing up for American industry. Expect the usual suspects to start boycotting Teslas—right before they hop in their Ubers to rage-tweet about it.

San Francisco’s “Most Evil Landlord” Proves Why Rent Control Is a Joke

Meet Sophie Lau, the 82-year-old real estate mogul who’s allegedly running San Francisco’s most dystopian housing operation. According to reports, Lau rents out squalid apartments, then turns around and sues tenants who try to leave. Because in the progressive utopia of San Francisco, it’s apparently easier to punish renters than to fix a broken housing system.

Lau, worth $6 million, owns 10 buildings and 70 units, yet insists it’s her tenants who are the problem. Meanwhile, an investigation suggests otherwise. But hey, in a city that hands out tents and needles faster than eviction notices, maybe “evil landlords” are just another feature of the system—not a bug.

Small Businesses Embrace AI

With inflation hammering wallets and labor costs soaring, small businesses are turning to AI—not Washington—for survival. A Goldman Sachs survey found that 69% of small businesses are using AI, up from 56% last year, proving that when the government makes it harder to hire, business owners get creative.

From AI-powered inventory scanners to automated customer service, small businesses are finding ways to cut costs and stay competitive. Meanwhile, more regulations, higher taxes, and labor policies make hiring humans a nightmare. But hey, at least AI doesn’t call in sick or demand a diversity quota.

California Is the “Happiest” State? Guess They Didn’t Poll the Taxpayers

According to a new WalletHub study, the happiest city in America is… Fremont, California. That’s right, folks—the state with sky-high taxes, rampant crime, and an exodus of businesses is apparently home to five of the top ten happiest cities. Either the people surveyed live in gated mansions, or California’s PR team is working overtime.

The study looked at factors like financial stability, leisure time, and income growth—because nothing says “happiness” like paying half your paycheck to the government while dodging a new “equity” tax. Meanwhile, places that actually protect your wallet, like Florida and Texas? Nowhere to be found. But hey, if living in a tent-free bubble of Silicon Valley millionaires is your definition of happiness, congrats, California—you win this round.

Dems Regret Acting Like Children During Trump’s Speech—Too Late Now

At least five Democrats are now realizing what the rest of America saw in real-time—throwing a tantrum during Trump’s address wasn’t exactly a winning strategy. Instead of acting like adults, they focused on petty disruptions while ignoring moments like Trump honoring a young boy with cancer. Now, the Monday morning quarterbacks are out, admitting they maybe should’ve shown a little class.

Sen. Adam Schiff (yes, that Adam Schiff) admitted their response was a "mistake," while Rep. Tom Suozzi said the party got caught up in disruptive behavior. Translation: They let their Trump Derangement Syndrome take over, and now it’s backfiring. Maybe next time, they’ll remember that voters actually watch these speeches—and childish stunts don’t pay off at the ballot box.

3 Big Things That Could Mess with Your Wallet Next Week: 🗓️

The Fed Decides If We’re Getting Economic Relief… or More Pain (March 20)

Jerome Powell and his merry band of economic wizards are meeting to decide whether interest rates should finally stop suffocating the economy. If they cut rates, expect a mini stock market rally, some mortgage relief, and real estate investors cracking open the champagne. If they don’t cut, well… good luck to anyone needing a loan, trying to start a business, or just attempting to ‘live’. Either way, this decision could make or break your 401(k).

The Retail Apocalypse Rolls On—Who's Closing Next? (March 18-22)

Another week, another round of retail chain obituaries. Macy’s, Kohl’s, and Best Buy are all dropping their earnings reports, and the early signs aren’t pretty. Inflation, shrinkflation, and whatever the heck Bidenomics ‘was’ has left Americans spending less, which means more store closures and layoffs are on the way. If you've been meaning to hit a closing sale, now might be your last chance.

The IRS is Coming for Your Money—Are You Ready? (March 15-22)

Tax season is in full swing, and if you were hoping for a quick refund, bless your heart. The IRS has already warned of delays (shocking, we know) due to “processing issues.” Translation: You’ll get your money when they feel like it. On top of that, new tax rules mean you might owe more this year—because the government definitely needs another $100 billion to send overseas instead of fixing, you know, America. If you haven’t filed yet, now’s the time—before they find a new way to take even more of your hard-earned cash.

Closing Thoughts:

Is America Really Heading for a Recession in 2025?

Ah, the age-old debate: Are we officially in a recession, or are we just “redefining” what a recession means? The White House swears everything is fine, Wall Street is riding a rollercoaster, and meanwhile, regular Americans are paying $9 for eggs and wondering why their local bank just shut down. So, let’s break it down—are we heading for a full-blown recession, or is this just more economic fear-mongering?

The Case for "Yes, We’re Screwed" Let’s be real—every sign is flashing red. Inflation isn’t really under control (despite the Fed’s best PR efforts), major retailers are dropping like flies, and 100+ bank branches have already closed in 2025 alone. The housing market? A mess. Layoffs? Stacking up. The economy is moving like an old Ford truck running on fumes. If the previous administration was actually ‘so great’, why do interest rates still have people clutching their wallets like they’re about to get mugged?

Then there’s corporate America. Small businesses are still getting crushed under government regulations, JPMorgan is raging over people working from home instead of paying for gas, and Wall Street is not feeling bullish. Historically, when banks and businesses start bracing for impact, the storm isn’t far behind.

The Case for "Calm Down, We’re Fine" Not so fast—there’s a counterargument, and it’s not completely crazy. The stock market is still holding up, unemployment rates haven’t officially spiked, and consumer spending, while slowing, hasn’t hit rock bottom. Could the economy just be cooling off rather than collapsing? After all, Trump is back in the game, and if there’s one thing we know, it’s that when he’s leading the charge, the market loves it.

Some argue that the doom-and-gloom predictions are just media hype. Yes, businesses are closing, but others are expanding. Inflation isn’t great, but it’s not hyperinflation. And let’s be honest—every time there’s a Republican running the show, the media suddenly rediscovers the concept of a “recession,” even when the economy is still moving.

So, What’s the Truth? Here’s the reality: Whether or not we technically hit a recession, the economy feels like one for millions of Americans. If your grocery bill has doubled, your savings are shrinking, and you’re watching businesses disappear left and right, you don’t need an official declaration from the Fed to tell you things aren’t great.

What do you think—are we already in a recession, or is the panic overblown? Let us know by replying to this email. We’re curious: Is America on the brink, or is this just another cycle of media fear-mongering?

Interested in reaching thousands of Americans? You can sponsor our newsletter here.